As anticipated from the last quarter, the upward trend in dealership profitability has now changed in Q2 and is headed downwards. The first half of 2023 shows a mixture of results in New Vehicle units that is still trending upwards; however, the average gross profit is slowly going back to the pre-pandemic average to which we are accustomed.

In Q2 2023, New Vehicle sales increased 8% year over year, from 309 to 333 units/per dealer. The easing in the New Vehicle supply chain, which resulted in more inventory availability, supported the Q2 sales growth. However, the growth was at a slower pace than the 11% YOY increase reported for Q1. The average New Vehicle Sales gross profit declined 51% from the prior year, from $3,438 to $1,681 per unit.

Return on Sales dropped from 6.3% to 4.3%. The downward trend on ROS is due to the decline in overall Gross Profit % Sales from 15.2% to 13.1%, combined with the slight increase of 0.3 % in Operating Expense as % Sales. The Operating Profit % Sales also is impacted unfavorably from 3.4% to 1.0%. The percentage of unprofitable dealers grew 6.6 percentage points to its highest at 8.5% for the first time in the last two years, from 1.9% of the network in Q1.

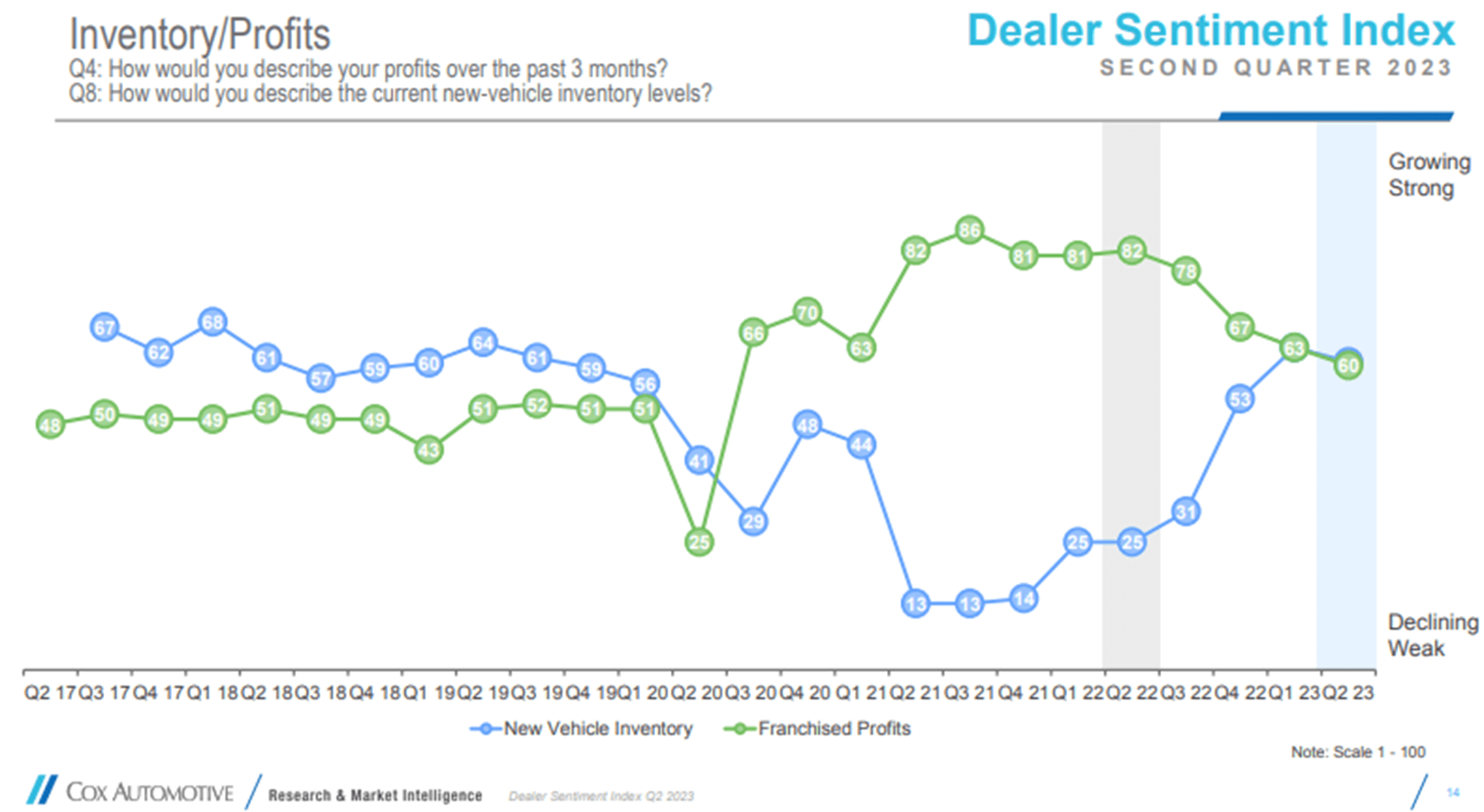

The Q2 Dealer Sentiment Index from Cox Automotive corroborates this trend from its survey of dealers. The results show the dealers are describing their profits are beginning to decline from the peak in Q3 2021 as the new vehicle inventory has made a dramatic rebound during the same period. However, profits remain above Pre-Pandemic levels.

*Cox Automotive DSI

*Cox Automotive DSI

New Retail Vehicles for June YTD increased 8% YOY from 313 to 340 units/dealer per month. Average New Vehicle Sales price remains flat at $45,188. The Days Supply is trending toward a pre-pandemic level at 21 days compared to 9 days the previous year due to supply chain improvement in early 2023.

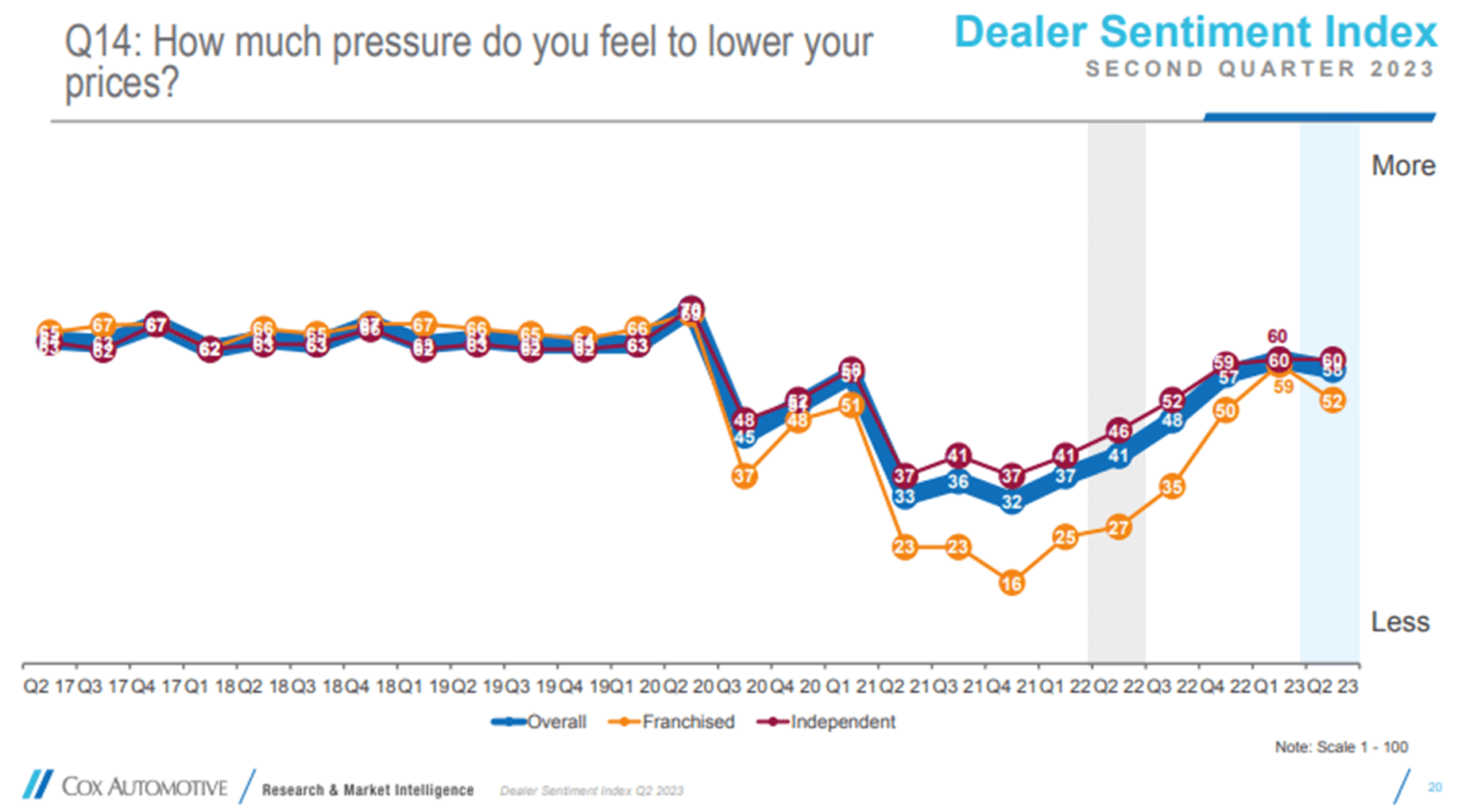

Again, from the Cox Automotive Q2 Dealer Sentiment Index, dealers are feeling an increased pressure to lower transaction prices to maintain sales performance, but the sentiment remains below the pressure felt during the Pre-Pandemic period.

*Cox Automotive DSI

*Cox Automotive DSI

On the quarter, Used Vehicle sales shows a nominal 1% increase YOY, confirming the softening outlook of vehicle sales in 2023. The Average Used Retail sales price reported a persistent declining trend for 9 consecutive quarters from $30,033/unit to $27,791/unit or 7% down YOY. Average Used Retail sales gross profit shows a similar decline from the previous quarter at 22% (vs. 23% in Q1 2023), down from $2,709/unit to $2,105/unit.

Surprisingly, Total Service ROs show a 1% decline YOY, however, the Total Service Sales per RO and Gross Profit per RO increased 11% and 12% respectively YOY. The Gross Profit per RO for CP Sales and Warranty increased 14% and 13% respectively.

Total Parts Sales per RO increased 4% YOY and Gross Profit per RO increased 6% YOY. Parts Inventory remains flat at around $400K.

Service Absorption continues a positive trend with a 4.9 percentage point increase from 54.8% to 59.6%.

Below are the continuing trends as agreed by the analysts in automotive retail market with a few items shifted:

Q2 2023 shows a softening increase in vehicle sales with the gross profit compromised. The high-volume sales with favorable gross profit during the pandemic years are in a rearview mirror. Dealers will need to embrace a new turn in the market for the next half of 2023.

Linda is a Business Management and Financial Analysis expert with experience in the Automotive Industry working for renowned OEMs.

Mark has devoted an entire career in the Automotive Industry with both OEMs and dealers thanks to an unmatched passion for cars.

Let us know how we can help you learn more.